Kopalnie Krypto Team - Friday 12 January 2024

Mining profitability of Chia illustrated with our miner example

In recent years - and even months - the global situation has drastically changed. This primarily concerns the energy sector, which has become the focus of intense efforts aimed at preventing a crisis. The emphasis on reducing electricity consumption has also impacted the cryptocurrency market. Projects based on the Proof of Work algorithm have suffered in terms of image, mainly due to their high electricity consumption. Consequently, attractive alternatives that utilize different consensus mechanisms have started to emerge. One of these is an eco-friendly cryptocurrency operating on the Proof of Space and Time algorithm - Chia.

Is Proof of Work Still Profitable?

It all depends on how we look at it and what resources we have. However, let's start with a bit of historical knowledge. In the era of the global energy crisis, electricity prices soared. This had a direct impact on the profits of miners extracting cryptocurrencies based on the Proof of Work algorithm. However, it wasn't the end of the world, as revenues, although smaller, were still noticeable. The problem arose when one of the key players in the market - Ethereum - decided to switch from Proof of Work to Proof of Stake. Then, mining this cryptocurrency with conventional miners became impossible. So, what happened to the miners? Primarily, they were left with expensive equipment, which for Ethereum purposes was useless. Some of them then gave up on PoW cryptocurrencies, putting their miners up for sale. It was then that the market was flooded with a significant number of graphics cards, which were difficult to sell for a reasonable profit. The second group of miners decided to connect their equipment to other blockchains. This, in turn, made mining cryptocurrencies operating on these blockchains more difficult.

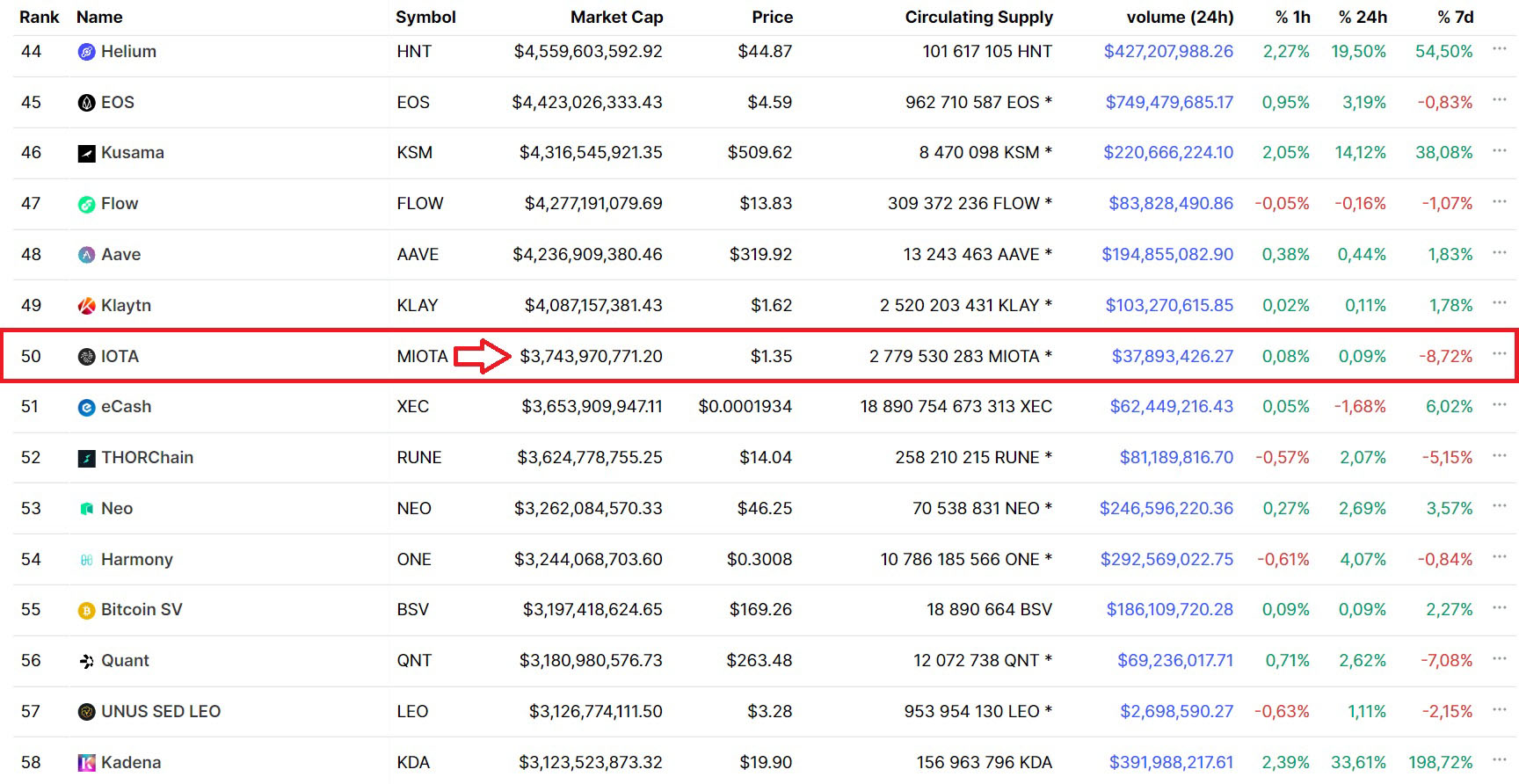

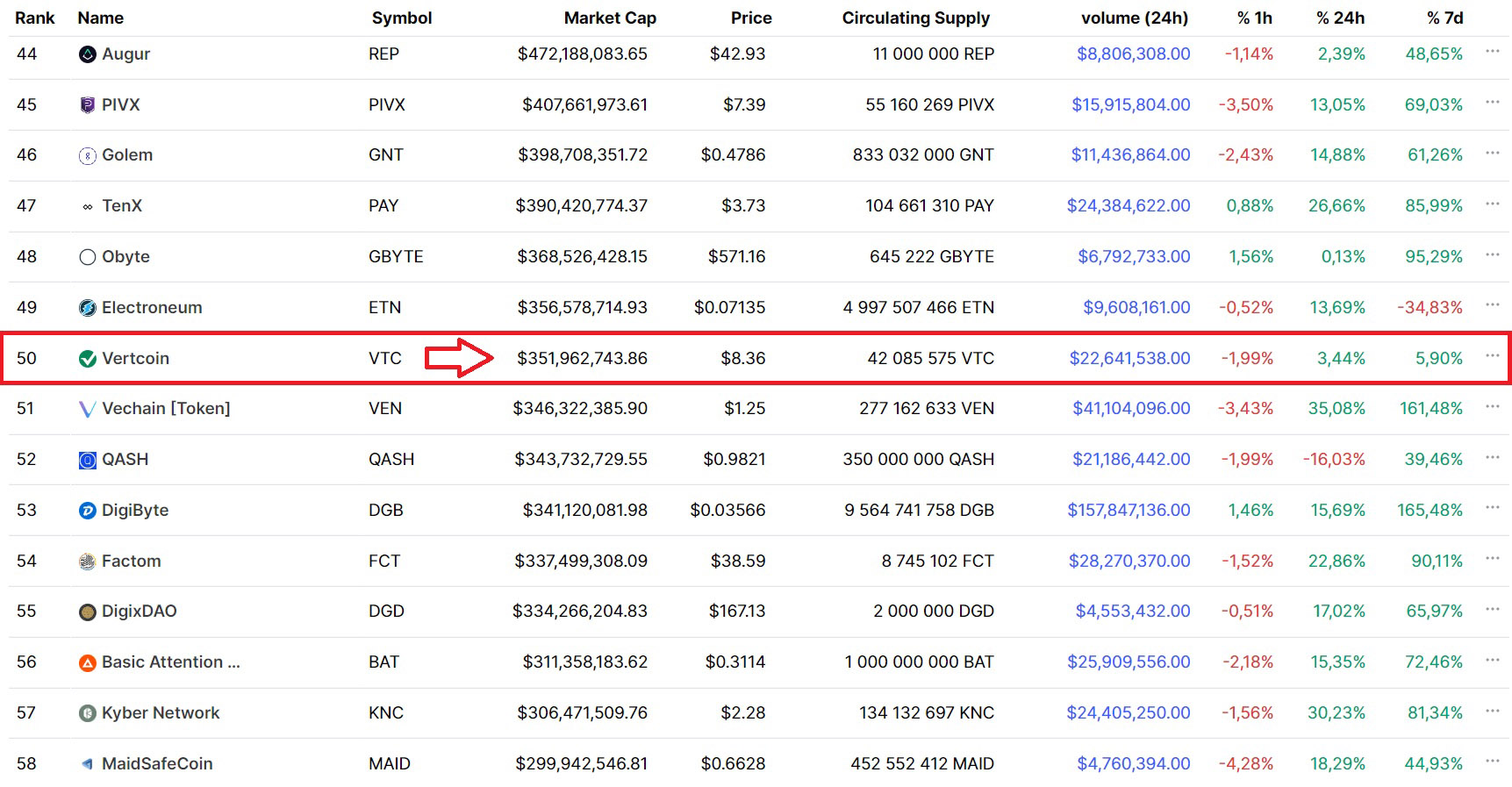

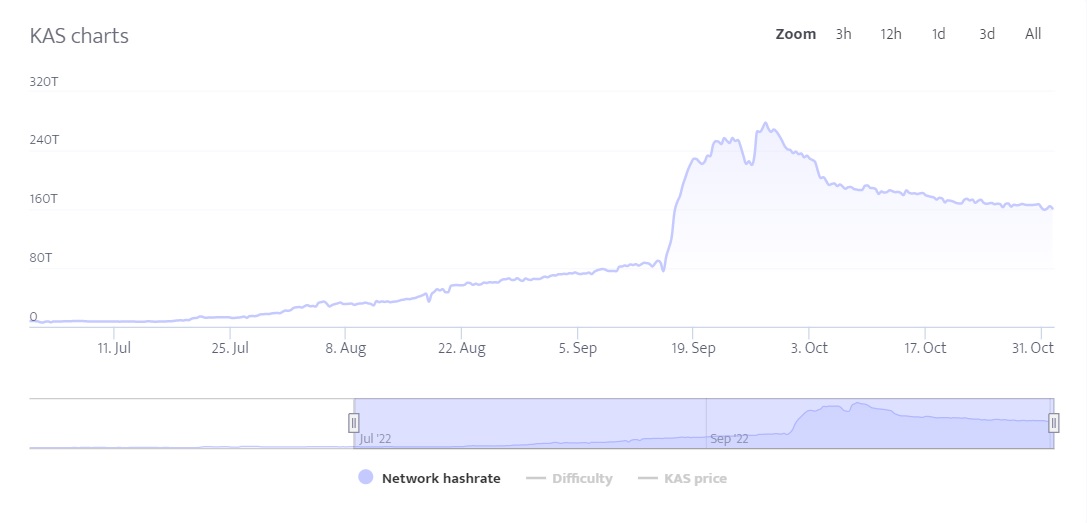

It's best to analyze this situation with a specific example. The charts below show how the difficulty of mining the largest cryptocurrencies based on PoW (including ETC, RVN, KAS) increased. The most drastic jump was recorded on September 15, the moment Ethereum switched to the PoS algorithm.

Source: minerstat.com

Source: minerstat.com

Source: minerstat.com

Alternative: Chia, the Cryptocurrency Based on PoST

In light of the above, some miners have come to believe that Proof of Work projects are no longer profitable. Is this correct? Not entirely.

It turns out that mining PoW cryptocurrencies can still be profitable. However, one must make more effort to ensure profitability. First and foremost, it starts with verifying and optimizing the energy efficiency of your miner. We need to ensure that it has the highest possible computing power with the lowest possible power consumption. And then there's electricity. We also need to delve into paperwork and check our current electricity rates. If the tariff in our region is highly unfavorable, it's better to steer clear of Proof of Work. We could alternatively use photovoltaic systems, but here we also need to consider installation costs and the type of contract. Once the basics are in place, we must be vigilant and look out for young, promising projects. Why these specifically? Can't we just mine Bitcoin since it's so valuable?

Indeed, it is. There's just one problem, which we described above - mining difficulty. If we now connect to the BTC blockchain, the chance of mining anything is exceptionally low. The network has grown to such an extent that competing with other miners has become senseless. Instead, we should be on the lookout for new projects and start mining them as soon as possible. The fewer network users, the more of that cryptocurrency we will accumulate. Even if it is worthless at the moment, it can dramatically increase in value in the future. However, these can't be just any projects, but those boasting a high sentiment index. These are the ones most likely to make it big in the future.

In conclusion, mining cryptocurrencies based on Proof of Work can be profitable, provided we meet several conditions regarding costs and the level of electricity consumption. We must also show above-average initiative in continuously observing the market and scouting for promising projects.

Alternative: Chia, the Cryptocurrency Based on PoST

Struggling with tariffs and photovoltaic installation can be burdensome. The same goes for the need to constantly watch the market. For ardent crypto enthusiasts, this might not be such a problem, but for beginners or those with other commitments, it certainly is. However, there is no need to worry, as there is an excellent alternative. It eliminates the need to worry about electricity bills because, unlike Proof of Work projects, its impact on the environment is minimal.

We are talking about the cryptocurrency Chia. It is an eco-friendly project based on the Proof of Space and Time (PoST) algorithm. It somewhat imitates the functionality of PoW blockchains, but instead of power-hungry graphics cards, it uses hard drives for operation. First, they are cheaper and readily available. Secondly, they draw minimal amounts of electricity from the socket. That's just one aspect of this innovative project.

Chia is not just a cryptocurrency. It's also a comprehensive ecosystem offering many practical functionalities. It inherits most of Bitcoin's functions and adds many of its solutions. These include, among others, the Offers mechanism, thanks to which transactions occur between two entities entirely on the blockchain. This has enabled the emergence of numerous decentralized exchanges (DEX) that significantly reduce the level of centralization, thereby positively affecting security. The Clawback system is also noteworthy, preventing mistakes. This mechanism allows the withdrawal of transactions during a predetermined time window. The creators of Chia have also built DataLayer technology, which enables the creation of decentralized databases. This ensures users that the data is reliable, as proof of its existence is on the blockchain.

So who are the creators of Chia? Are they another enigmatic group of programmers like Nakamoto? Far from it! The birth of the Chia cryptocurrency is attributed to the Californian company Chia Network, which brings together specialists from various fields of technology and finance. The company is fully transparent in its operations, thereby directly influencing the community's trust in the project. It's also worth mentioning that Chia Network is currently working on conducting an IPO process. In other words, it plans to go public, thus becoming a public company.

In summary - Chia Network is a project with solid technological foundations, extensive and, most importantly, useful functionality, and a low impact on the environment. It is also admirable that the creator of this revolutionary cryptocurrency is a legally operating company that builds its ecosystem based on its expertise in the industry. Therefore, it's not another Bitcoin clone, but a solution built from scratch aimed at eliminating all the shortcomings of Proof of Work cryptocurrencies.

Profitability of Mining Chia with Crypto Mines

Our calculations were based on the results obtained using our proprietary Harvey miners. This line offers many hardware configurations (currently 7 different models), so profitability should be considered on several examples. To avoid unnecessarily complicating calculations, we selected three variants:

- Harvey Home Lite

- Harvey Home Pro

- Harvey Business Pro +

In addition, in our calculation, we took into account the current network space of 32,914 EiB and adopted the current price of Chia cryptocurrency (XCH) at 38.54 USD (1 USD = 3.94 PLN). Here are the results:

| Harvey Home Lite | Current Price (39 USD) |

Maximum Price (1500 USD) |

| Daily XCH Mining | 0.0085 pcs | 0.0085 pcs |

| Monthly XCH Mining | 0.2601 pcs | 0.2601 pcs |

| Monthly Profit in USD | 10.14 USD | 390.15 USD |

| Monthly Profit in PLN | 39.95 PLN | 1537.19 PLN |

| Harvey Home Pro | Current Price (39 USD) |

Maximum Price (1500 USD) |

| Daily XCH Mining | 0.0342 pcs | 0.0342 pcs |

| Monthly XCH Mining | 1.0404 pcs | 1.0404 pcs |

| Monthly Profit in USD | 40.58 USD | 1560.6 USD |

| Monthly Profit in PLN | 159.89 PLN | 6148.76 PLN |

| Harvey Business Pro + | Current Price (39 USD) |

Maximum Price (1500 USD) |

| Daily XCH Mining | 0.2734 pcs | 0.2734 pcs |

| Monthly XCH Mining | 8.3228 pcs | 8.3228 pcs |

| Monthly Profit in USD | 324.59 USD | 12,484.20 USD |

| Monthly Profit in PLN | 1278.88 PLN | 49187.75 PLN |

Of course, to make the calculations complete, one must also consider additional costs of Chia farming. Besides the purchase of a miner, key aspects include electricity consumption and equipment depreciation. So, let's go step by step.

As for electricity consumption, we took into account the average price of electricity in Poland, which is 0.73 PLN for 1 kWh (1000 W). The average level of electricity consumption for the above-mentioned variants of miners is as follows:

- Harvey Home Lite - 150 W

- Harvey Home Pro - 200 W

- Harvey Business Pro + - 700 W

These results should be multiplied by 24 to get the daily value - this way, we determined that the daily electricity consumption of the described models of miners is as follows:

- Harvey Home Lite - 3.6 kWh

- Harvey Home Pro - 4.8 kWh

- Harvey Business Pro + - 16.8 kWh

Then we multiply the above results by the average electricity price. As a result, we get the daily maintenance cost of the equipment, based on which we can also calculate monthly and annual expenses. For the described Harvey miner models, it looks like this:

- Harvey Home Lite - 2.63 PLN daily / 78.84 PLN monthly / 946.08 PLN annually

- Harvey Home Pro - 3.50 PLN daily / 105.12 PLN monthly / 1261.44 PLN annually

- Harvey Business Pro + - 12.26 PLN daily / 367.92 PLN monthly / 4415.04 PLN annually

It's worth adding that electricity consumption can be reduced, for example, by creating a farm based on server solutions, such as RACK cabinets. Another issue is the fact that the room where the farm will be located will be incidentally heated - in an area of 20 m2, it is easy to achieve room temperature without turning on a radiator.

Regarding depreciation - after one year of use, equipment purchased as new for 262 thousand PLN should not lose more than 5% of its value. At the time of writing this article, we are most likely at the beginning of a bull market, demand for cryptocurrency miner equipment is still small, and there is a lack of components in the market - the price of electronics is practically stagnant. It is very likely that a miner purchased at this moment will be worth even more during an advanced bull market, where the demand for such equipment will be high, and the supply very limited.

Bear and Bull Market - When to Invest, When to Harvest?

The above calculations prove that farming with an energy-efficient Chia miner is profitable even in a bear market. Does this mean that one should immediately sell the mined cryptocurrencies? Absolutely not. It would be a very bad move during a bear market. The point of investing in equipment is to earn properly, even if we have to wait a few years for substantial profits. It's best to keep a cool head and wait until the bull market - then the prices of cryptocurrencies are the highest, and the return on investment significantly exceeds the incurred costs.

During a bear market, it is advisable to focus on investing - it is during this period that one can hunt for the best investment opportunities. When an advanced bull market arrives, farming will be difficult, as farmers will join the network en masse, and rewards will be distributed among a larger number of people. There are also other factors that are easy to predict. Examples include problems with component availability or rising equipment prices. Those who survive the bear market can expect a generous payout during the bull market, i.e., a period of profit realization.

How Will the XCH Price Develop?

At the time of writing this article, the price for 1 XCH is 38.54 USD, while the market capitalization is maintained at around 364,000,000 USD. Chia is in 166th position in the ranking of all cryptocurrency projects. Not too high? And that's good because it only shows how undervalued this project is. Given the scale of its innovation, entering the TOP 50 seems very likely (to say the least), especially if the project maintains its current pace of development. Currently, the Chia Network project is investing in the ecosystem and lucrative business collaborations - the time for a marketing campaign will come later. Then users will have access to a complete and functional product.

However, this does not mean that the development of the Chia Network project is problem-free. We mentioned earlier that the Chia Network is currently working on conducting an IPO process. Unfortunately, due to the loss of a banking partner, who ended its operations, this process has been significantly prolonged. Chia Network company was forced to reduce staff and reach for the so-called Strategic Reserve (pre-farm). For many community members, this was a controversial move, but necessary for Chia to continue to develop. Currently, a so-called market maker has been engaged, who actively buys and sells cryptocurrencies to ensure liquidity and stabilize prices in the market. In other words, it stimulates the turnover of XCH on exchanges. Such actions will certainly reflect on the price of Chia.

Taking all this into account, it can be stated with high probability that Chia has great chances for significant increases in the upcoming bull market. Of course, it should be noted that these are predictions based on the experience of our team and market observations. However, everyone should form their own opinion about the Chia project and its chances of success. Surely following posts on our site will help in this.

Chia Network is an innovative, energy-efficient, and secure project. All this is, of course, very important, but in the context of the XCH price, it is worth taking a closer look at the project's cryptocurrency. While fiat money (the one we use every day) is constantly losing value, as central banks have been printing more of it for decades, driving inflation, digital money usually has built-in mechanisms to protect it from inflation. When Satoshi Nakamoto created the first cryptocurrency - Bitcoin (BTC) in 2009, he ensured the implementation of a mechanism to reduce inflation (halvings). What are the so-called halvings? In the case of BTC, once every four years, the reward for mining a block is halved, which automatically reduces inflation by half. In the long run, halvings stimulate the price of BTC to increase.

Here is the translation of the provided text into English, leaving the HTML code unchanged: ```html

As this mechanism proved to be very effective in the case of BTC, the creators of Chia Network also decided to implement it in XCH. However, the halvings, which reduce inflation by half, occur every three years instead of four as in the case of BTC, which means that inflation in this cryptocurrency will decrease even faster than in Bitcoin. At the time of writing this article, there are approximately 9,450,000 XCH in circulation (unlocked supply). Let's take a look at how the subsequent halvings are scheduled.

- from 2021 to 2023 - 2 XCH per block,

- from 2024 to 2026 - 1 XCH per block,

- from 2027 to 2029 - 0.5 XCH per block,

- from 2030 to 2032 - 0.25 XCH per block,

- from 2033 indefinitely - 0.125 XCH.

Thanks to halvings, inflation on XCH will continue to decrease - similar to what is happening with BTC. Considering the growing adoption of Chia Network, including collaboration with the World Bank itself and supporting subsequent high-profile projects (like Climate Warehouse or Carbon Opportunities), it is only a matter of time before demand begins to exceed supply for this cryptocurrency, and the price of XCH begins to rise.

Profitability of Chia Mining: When is the Next Bull Run and How Will XCH Perform?

After the above introduction, we can finally discuss how we think the price of Chia will evolve. We will consider several key factors, including four-year cycles in which bull runs occur in the cryptocurrency market, market capitalization, and the number of cryptocurrencies in circulation.

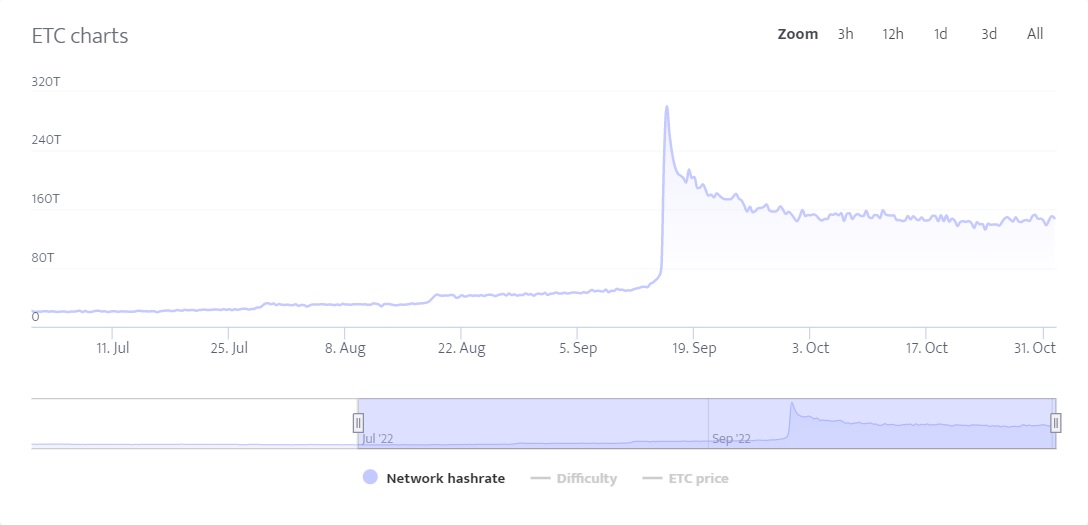

Based on how the cycles have shaped up so far, we can expect the next peak of the bull run at the end of 2025. This is what the market capitalization of number 50, on the list of cryptocurrencies with the highest capitalization, looked like around the peak of the last bull run (specifically November 7, 2021):

Source: coinmarketcap.com

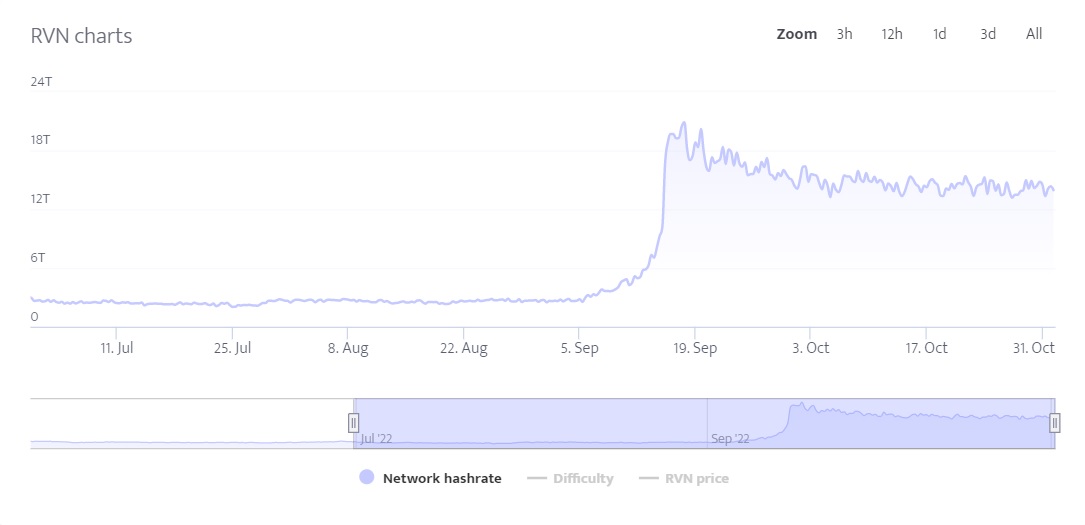

Meanwhile, during the earlier bull run, it looked like this (data from December 17, 2017):

Source: coinmarketcap.com

In 2017, Vertcoin, the last cryptocurrency of the then TOP 50 Market Cap, had a capitalization of 351 million dollars. In 2021, the market capitalization of IOTA, which then closed the top fifty, already exceeded 3.7 billion dollars, which is more than 10 times more than in the previous bull run.

This allows us to conclude that with each bull run, more capital flows into the market. There is no reason to believe that the trend will reverse next time, especially observing the ongoing adoption of cryptocurrencies. Let it not be a tenfold increase this time, but even a twofold smaller, i.e., fivefold.

Let's also assume that Chia Network lands in the top fifty during the next bull run (which is very likely considering the things that are currently happening in the Chia project). With quite rational calculations, the Market Cap of XCH would then be around 18.5 billion dollars (3.7 billion x 5). ;

We must also take into account how many cryptocurrencies may be in circulation by then. Considering the previously estimated market capitalization and performing elementary division, we get the forecasted price for 1 XCH. So – let's get to work.

Forecasted XCH Price – Detailed Calculations

We have already assumed that the peak of the next bull run will be at the end of 2025. We also know that there are currently 9,450,000 XCH cryptocurrency in circulation.

So far, for each Chia block, a reward of 2 XCH was awarded. With a pace of 32 blocks every 10 minutes, we were talking about 9216 XCH per day until the end of 2023. The year 2024 has just arrived, so soon the inflation on XCH will be halved, which means that only 4608 XCH will be added every day.

Taking into account the above data, it turns out that the total amount of XCH available in circulation by the end of 2025 will be: 13,455,360. We then divide the estimated Market Cap by this number. 18,500,000,000 : 13,455,360 = 1374 USD per XCH – that is the predicted price of Chia.

We emphasize once again: this is not a wild fantasy, but quite rational calculations. It is also necessary to consider that by farming XCH on our miners, we can simultaneously farm many other cryptocurrencies based on the PoST algorithm. Currently, most of these cryptocurrencies have a market capitalization of several tens/hundreds of thousands of dollars. Considering how much capital will flow into this market in the next bull run, a 100x from such a small capitalization is really not much.

Our miners are currently mining XCH and over forty other cryptocurrencies using the PoST algorithm. You never know which project will catch the biggest hype in the next bull run and provide the best return on investment. That's why it's worth farming them all.

Did anyone suspect before the previous bull run that the meme coin Shiba Inu would achieve a multi-billion dollar capitalization, and that a $100 investment in that project at an early stage would change someone's life? Nevertheless, we prefer to remain conservative and underestimate the projected profits, which is why we did not take into account the other cryptocurrencies we acquire with our miner in our calculations. We proceed on the assumption that it's better to be pleasantly surprised than bitterly disappointed.

Summary: Profitability of Chia Mining on Our Miners

Based on the above calculations and assuming that Chia will be worth 1374 USD per piece in the next bull run, we can further refine the calculations regarding the profitability of our miners. We would like to point out that you can familiarize yourself with the full offer of our farms here – we are also open to collaboration with business partners and have a special offer prepared for them.

To put it plainly: we invest time and money in Chia ourselves. Most of our team members own their own miners. We believe in this project, based on the above calculations. However, we emphasize clearly (and once again): this is SOLELY OUR OPINION. We do not provide investment advice and do not encourage anything. However, we believe that, looking at the development of the Chia Network project, the biggest risk for us would be to give up on this investment. That is why we established the Crypto Mines service and bring the topic closer to the Polish community as best we can. We encourage you to follow the articles we publish here and to form your own opinion about the Chia Network project.