Kopalnie Krypto Team - Saturday 16 December 2023

How to heat your home and make money from it?

Winter this year has apparently taken by surprise not just the drivers. Meanwhile, bombarded with successive laws fighting the carbon footprint, we face an endless dilemma regarding the heating of our homes. Should we stick to coal, install gas heating, or perhaps a heat pump? There are many options, and in reality, there's no certainty as to which one is the most reliable and cost-effective in the long run. But what if there's another option, one that could also earn us some money?

Fusion of Proof of Work with photovoltaics

Gazing upon the endless expanses of snow, we had an epiphany. After all, we already have some experience in mining cryptocurrencies. We also know what, aside from profits, is a byproduct of mining. All computers produce a certain amount of heat, and cryptocurrency miners are no exception. So, we visited our test center, where we experiment with miners utilizing the Proof of Space and Time algorithm. We placed our hands on them and… for the first time, we were positively disappointed with an aspect of our equipment – it doesn't emit enough heat.

We thus returned to the drawing board. We knew there had to be a way, and that's when we realized we should go back to our roots. Our beginnings extend far beyond the birth of Chia. Before our team favored cryptocurrencies from the Proof of Space and Time algorithm for their energy efficiency, we did exactly what other blockchain enthusiasts did. Yes – we mined cryptocurrencies based on the Proof of Work algorithm. We never forgot that sight: miners equipped with dozens of graphics cards and electricity meters spinning so fast they could fly off. The most palpable, however, was the temperature, which would not embarrass a sauna.

That was it! Just use the Proof of Work miners, and we have heat guaranteed! Similarly, high electricity bills – that became our next challenge. We didn't have to ponder over this for too long. The answer was actually on the roofs of most homes. We're talking, of course, about photovoltaics, thanks to which our miners will be powered directly by the sun's energy.

Putting everything together

Since we had the theoretical foundation of the technology already in place, we started implementing our plan. Our target became a two-story building with a usable area of almost 300 square meters, with its basement serving as our main operational base. First, we decided to harness solar energy. For this, we installed a 50 kW Huawei inverter. To this, we connected the solar panels on the roof with a total power of 24 kW. Why such an overkill with the inverter? This allowed us the possibility of expanding the installation in the future. This way, we can confidently double the number of panels, if necessary. The electricity thus generated powered five miners mining cryptocurrencies based on the Proof of Work algorithm. So, we have cryptocurrency and heat generators powered by solar energy, located in a tight space on the lowest floor of the building.

As we know from physics lessons, warm air rises. We need to capture and use it for our needs. For this, we created a simple installation that sucks in the air accumulating under the ceiling and then distributes it throughout the building. This setup is quite standard, so there is no “black magic” here. Only the installation of an air filter at the air inlet and the insulation of the air ducts along sections that should not give off temperature are important. This way, we minimize heat loss.

How much can we save?

After reading our thrilling story, you're probably wondering how much you can actually save with this innovative heating method. The answer is not straightforward, as many individual factors come into play.

Building

In the previous part of this article, we described the building we had available for creating our installation. To recap: it was a two-story building with a usable area of about 300 square meters. It's also worth noting that it was insulated. The construction of the heat distribution installation was basic – no innovative technologies were used in this regard. To heat this particular building, five cryptocurrency miners were used, which in this case were more than sufficient. We estimated that they could probably also heat a similar building with a space of up to 500 square meters.

So, we have several variables to consider. Firstly, the construction of the building – the number of floors, size and layout of rooms, and the way it's insulated. The second issue is the construction of our heat distribution installation, namely its proper insulation and the way it's routed between the various rooms. All these factors must be taken into account to minimize the loss of heat we produce.

Electricity consumption

Now it's time to address the issue of electricity consumption. In our case, we have five miners simultaneously mining several cryptocurrencies using the Proof of Work algorithm. The power consumption of a single miner is not constant, but we determined with a meter that it ranges between 800 – 1000 W. Of course, this consumption will vary depending on the construction of the particular miner. As is known, in the case of electrically powered equipment, not only power matters, but also energy efficiency. Thus, we can build two different miners with the same computing power, but one of them achieves it at the cost of a much larger amount of electricity, while the other offers the same power, consuming less energy. Therefore, when selecting equipment, the main goal should be energy efficiency, so the numbers on the bills are as low as possible.

How much electricity will the photovoltaics generate?

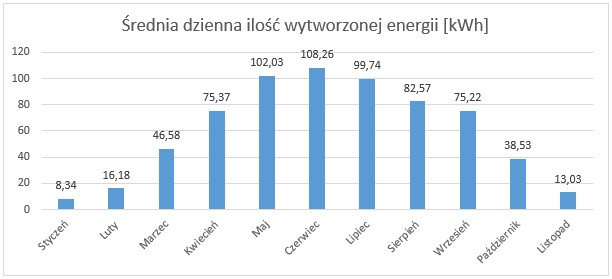

The energy efficiency alone is not enough to ensure that cryptocurrency miners don't destroy our wallets. Therefore, it is necessary to supplement with solar energy, which we will convert into electricity using photovoltaics. So, what kind of installation should we invest in? It all depends on how many miners we have and how much energy they consume. For example: our miners consume an average of 84 kWh to 120 kWh of electricity per day. As mentioned earlier, our photovoltaic installation consists of a 50 kW inverter and panels with a total power of 24 kW. How much energy can we generate with such an installation and to what extent will it cover the needs of our miners? It all depends on the positioning of the panels, the region we are in, and the time of year. The following chart shows the average amount of electricity generated daily by our solar panels over the past 11 months:

As you can see, in the spring and summer, our photovoltaic installation can almost completely cover the needs of our miners.

Electricity bills

This is another issue considered individually. Regardless of whether and what kind of miners we have, and whether our installation is supported by photovoltaics, determining the costs of electricity is difficult to estimate. Firstly, it's important to realize that electricity is consumed not only by miners but also by all other electrical devices in the apartment or building. The simplest way is to keep a personal record of meter readings, which will help estimate the individual level of electricity consumption.

The next issue is the type of electricity contract. There are people enjoying a rate of 0.35 PLN, but there are also customers whose contracts show a value of 3 PLN per 1 kWh. The same goes for the photovoltaic installation. Here, too, it's important to ensure that we sign a contract at the most favorable rate for us.

How much can we earn from cryptocurrency mining?

Compared to all the issues we have described, this aspect is the biggest bag of variables. It is really impossible to unequivocally determine how much we can earn from cryptocurrency mining. Everything depends on the equipment we have, the projects we mine, and how we manage our resources (i.e., cryptocurrencies).

The equipment here is not a mystery. The more powerful the miner, the greater the chance of successful mining. However, let's not forget about energy efficiency - we need equipment with high computational power, which is achieved with relatively little electricity consumption.

Another issue is the selection of cryptocurrency projects. We cannot just jump on Bitcoin and expect to be able to mine anything. The longer a project exists, the smaller the chance of mining it. Over time, blockchains grow, and the more people who want to mine, the harder it is to compete with other miners. That's why it's important to closely monitor the market and look out for new, promising projects. At the beginning of a network's existence, the difficulty of mining is very low. Then we have a chance to accumulate as much of the cryptocurrency as possible. However, over time the difficulty of mining will increase, and less crypto will fall into our wallet.

However, there is nothing scary about this if the project gains in value. Here comes the last issue, namely the way of managing resources. Imagine that we are mining a cryptocurrency worth 100 PLN. We want to cash it out immediately, so we withdraw all our profits as soon as possible. Let's assume we have a friend who mines exactly the same cryptocurrency using an identical miner. At the end of the year, you analyze your revenues and it turns out that our friend earned five times more. Why did this happen? For a simple reason: he "held" the cryptocurrency in his wallet and sold it when it gained more value.

The above observations show that profits from mining cryptocurrencies do not come solely from mindless mining of the first projects that come along. It is an issue that should be approached by thinking carrefully. Only then can we count on getting rich.

Summary

It turns out that the by-product of equipment operation can be used to one's advantage. However, this does not mean that you should dismantle your current heating installation, buy several miners, and heat your house with them. The idea is primarily aimed at those who mine cryptocurrencies based on the Proof of Work algorithm and would like to find an additional use for their equipment. Especially if they are users with access to renewable energy sources and cheap electricity. Experiments by our team also show that cryptocurrencies have much greater potential than it might seem.